child care tax credit payment dates

If you select direct deposit your money will be paid out on that date. Decembers payment could be the final child tax credit check.

![]()

2021 Advanced Payments Of The Child Tax Credit Tas

Monthly child tax credit payments to begin arriving July 15.

. Here are further details on these payments. Alberta child and family benefit ACFB All payment dates. Empire State child credit additional payment computation table.

17 March - England and Scotland only. Besides the July 15 payment payment dates are. In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with payments going out beginning in October.

If your line 19a amount is your payment based on your 2021 Empire State child credit is. The IRS pre-paid half the total credit amount in monthly payments from. The Child Tax Credit Eligibility Assistant lets parents check if they are eligible to receive advance Child Tax Credit payments.

Explore PREVIOUS COVERAGE. 4 January - England and Northern Ireland only. Equal to or greater than but less than.

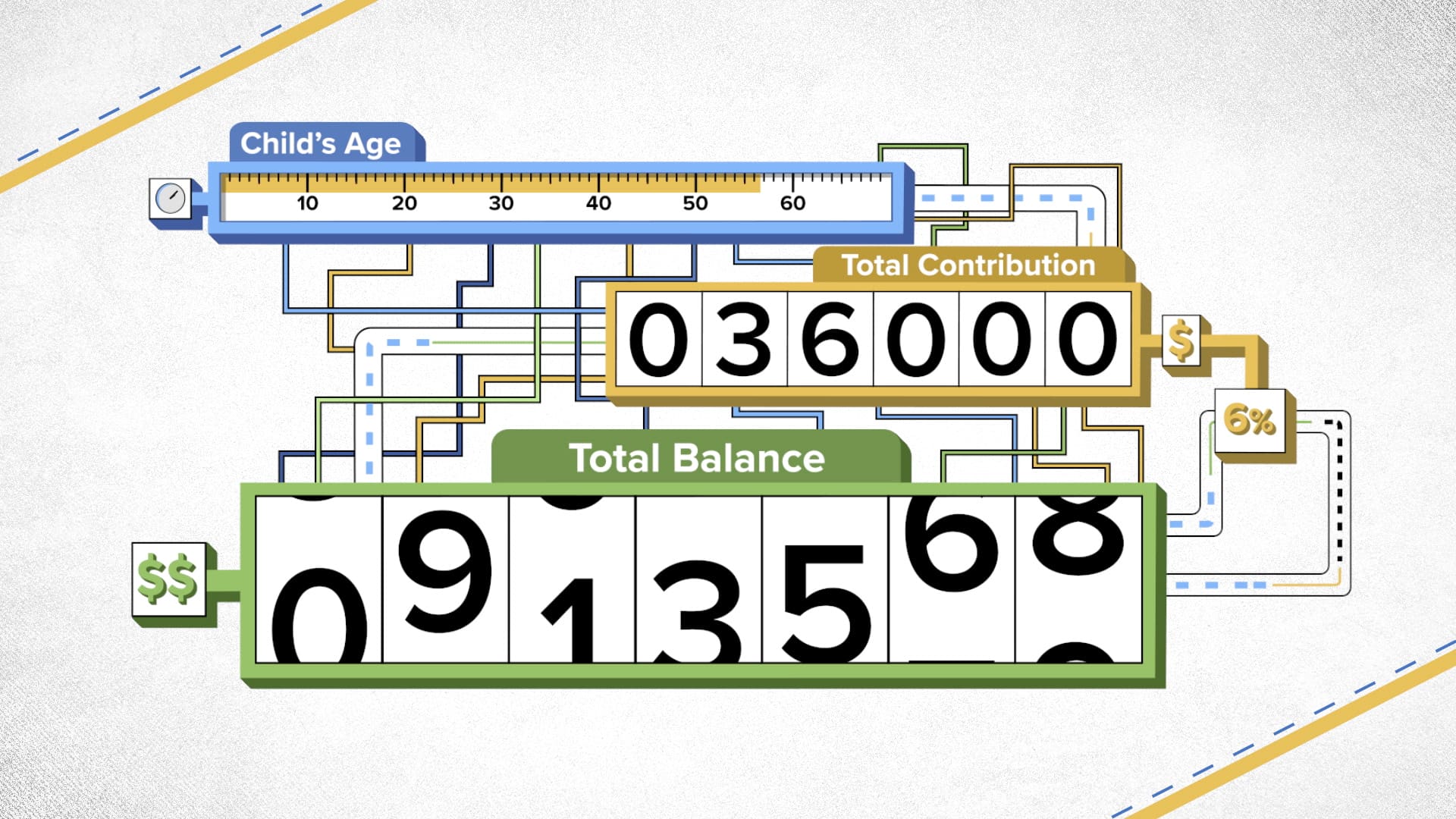

The Child Tax Credit CTC provides financial support to families to help raise their children. Wait 10 working days from the payment date to contact us. Child Care Tax Credit Payment Dates September 17 2021 Vaseline care care child payment The way the child tax credit payments will be divided between 2021 and 2022.

Because of the COVID-19 pandemic the CTC was expanded under the American Rescue Plan of 2021. When you claim this credit when filing a tax return you can lower the taxes you owe and potentially. The dates for the child tax benefit payment is usually near the end of the month around the 20th.

Well tell you when this payment will arrive and how to unenroll. Due date Payment date. The last round of monthly Child Tax Credit payments will arrive in bank accounts on Dec.

Users will need a copy of their 2020 tax return or. 2 days agoThe Internal Revenue Service wants more than 9 million people who did not get COVID-19 stimulus payments child tax credits or any other tax credits to claim their money. In Connecticut families can.

Citizens with income below 75000 or married couples with an income below 150000 were eligible for all three payments and the full amount of each. Families will see the direct deposit. You will not receive a monthly payment if your total benefit.

Heres what to expect from the IRS in 2022. Only one child tax credit payment is left this year.

These Are All The Important Child Tax Credit Dates You Need To Know

Child Tax Credits Deposited Friday Why Yours Possibly Did Not Come

What Is The Child Tax Credit And How Much Of It Is Refundable

Up To 4 1 Million Households Still Owed 3 7 Billion In Stimulus Payments Is Yours One Of Them Al Com

These Are All The Important Child Tax Credit Dates You Need To Know

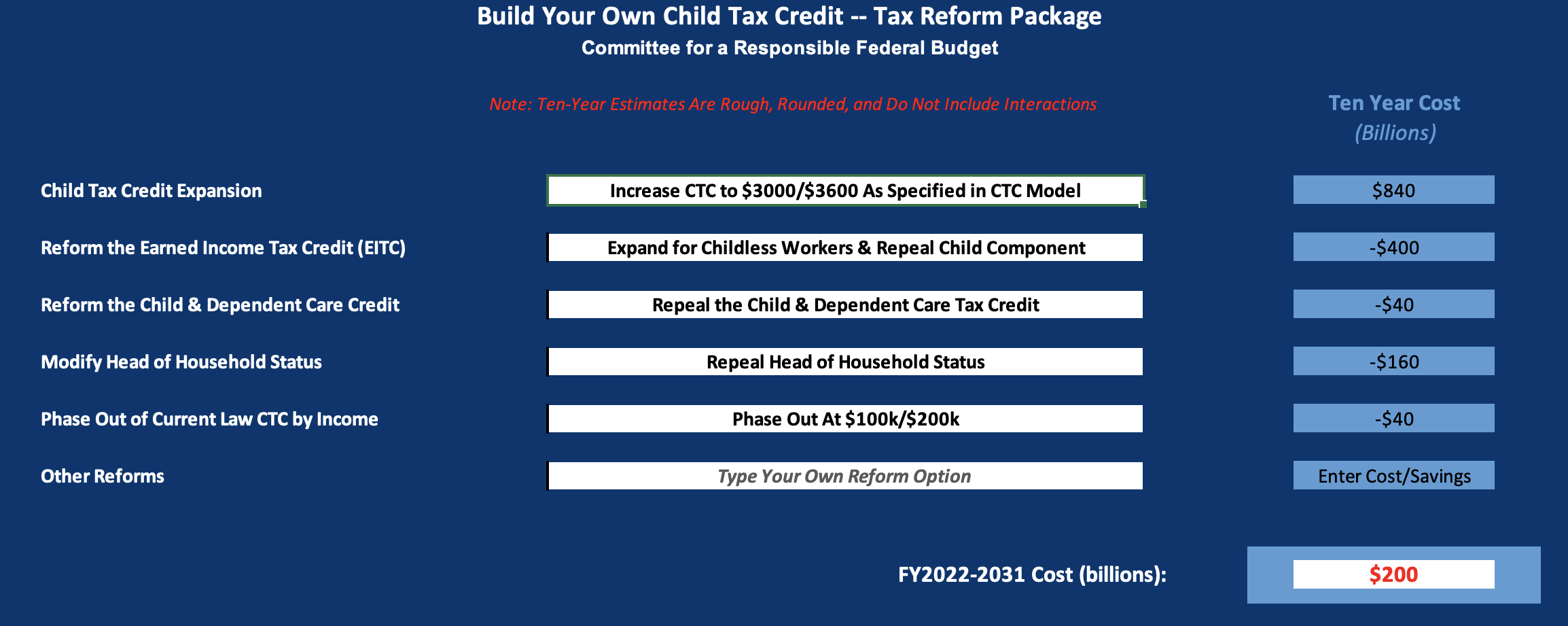

Build Your Own Child Tax Credit 2 0 Committee For A Responsible Federal Budget

Didn T Get Your Child Tax Credit Payment Here S What To Do Wftv

Irs Offers Overview Of 2021 Tax Provisions In American Rescue Plan Nstp

Changes To The Child Tax Credit Commerce Bank

Dates For The Advanced Child Tax Credit Payments

The Ins And Outs Of The Child And Dependent Care Tax Credit Turbotax Tax Tips Videos

3 7 Million More Children In Poverty In Jan 2022 Without Monthly Child Tax Credit Columbia University Center On Poverty And Social Policy

What To Know About The First Advance Child Tax Credit Payment

How Many Child Tax Credit Payments Remain For 2021 As Usa

Child Tax Credits What To Know About Monday S Deadline

How Families Are Spending Advance Child Tax Credit Payments Don T Mess With Taxes

How To Apply For The Connecticut Child Tax Rebate Before The Deadline Sunday Connecticut Public

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)